As Binary options trading trend continues to develop rapidly, more and more brokers become interested in providing Binary Options trading to their clients.

Binary Options trading technology is also one of the "simplest" and requires a simple web trading platform to operate.

Let's name several technology providers who offer White label platforms for Binary Options trading.

Binary Options White label platform providers

TradeSmarter - a technology and software provider of binary options - offers a web-based platform solution, with branding integration and full customization for any online company looking to enter the binary options industry.

"We wanted to build a binary options platform that is sophisticated yet simple and fun..." - said a TradeSmarter’s CEO Yoni Avital.

While being simple and intuitive the platform offers many features that can appeal to newbies as well as experienced traders.

Platform's main features:

- Two platform views (simplified and expanded)

- Scalable trading charts window

- Open Positions window

- Trading history window

- Market sentiment bars

- Easy option selection from the Asset index

- account balance window with money invested, available cash and bonuses

Investment types:

- Digital (High/Low)

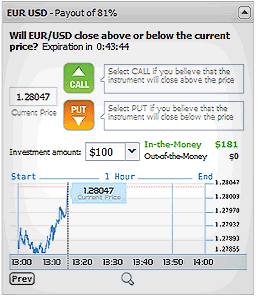

TradoLogic - binary options trading platform provider - offers high-performance web-based trading platform BINARIX, which specializes in binary options and provides great flexibility, quick and easily customization with an emphasis on client's experience.

The cross-platform solution enables clients to trade from any platform: website, desktop, tablet, mobile device or a trading console.

In addition, TradoLogic provides brokers with a number of risk management tools, for deal management, monitoring, alerting, fraud prevention etc.

Platform's main features:

- Take profit and stop loss before option expires

- Extend the expiration time of a particular option

- allows to purchase an "Insurance Policy" for a particular option

- allows to change speculation to the opposite direction

- increase their investment on an open option

- split investment

- trading from chart itself

Investment types:

|

- Digital (Above/Below)

- Range (In/Out)

- Touch (One-Touch/No Touch)

- Triple

- MatriX

- 60 seconds

|

- Open Markets (Trading Exchange)

- Straddle Option

- Pool Trading

- Grid Option

- Social Trading

- Forex Trading

|

Home

Home